Did you know 72% of students need affordable tech for school? Finding the best budget laptops doesn’t mean compromising quality. Our 2025 guide reveals top picks that balance price and performance perfectly.

Introduction to Dave Ramsey’s Baby Steps

In today’s rapidly evolving financial landscape, mastering personal finance is not just a luxury—it’s a necessity for achieving true wealth and security. Inspired by Robert Kiyosaki’s analytical approach, this section delves into the foundational principles of Dave Ramsey’s Baby Steps, a proven framework for transforming financial chaos into disciplined prosperity. As we explore this, remember that financial education empowers individuals to break free from debt cycles and build lasting assets, making it essential for navigating the uncertainties of 2025 and beyond.

Understanding the Importance of Financial Education

Financial literacy serves as the bedrock of personal empowerment, enabling informed decisions that prevent common pitfalls like overspending or debt accumulation. In 2025, with economic volatility on the rise—from inflation spikes to job market shifts—a lack of financial knowledge can trap individuals in a cycle of dependency. By embracing education, you gain the tools to control your money rather than letting it control you, fostering resilience in an unpredictable world.

Key Concepts

- Personal Finance fundamentals: This involves core practices such as budgeting, tracking expenses, and distinguishing between assets (which generate income) and liabilities (which drain resources). For instance, consistently living below your means allows you to allocate funds toward wealth-building activities, aligning with Kiyosaki’s emphasis on cash flow management.

- The role of financial literacy in modern society: In 2025, financial literacy is critical for societal stability, as it reduces reliance on government aid and credit systems. Studies show that financially literate individuals are 30% less likely to face bankruptcy, highlighting how education drives collective economic health—especially amid global challenges like digital currency adoption and automation-driven job losses.

Overview of Ramsey’s Seven Steps

Dave Ramsey’s Baby Steps provide a sequential, actionable roadmap for achieving financial independence. This method builds on the principles discussed earlier, ensuring each step reinforces your foundation. By 2025, this structured approach has helped millions eliminate debt and accumulate wealth, proving its effectiveness in diverse economic conditions.

Step-by-Step Summary

Here’s a concise overview of each Baby Step and how it contributes to comprehensive financial planning:

| Step | Description | Contribution to Financial Planning |

|---|---|---|

| 1 | Save $1,000 for a starter emergency fund | Creates an immediate buffer against unexpected expenses, preventing debt reliance and instilling discipline. |

| 2 | Pay off all non-mortgage debt using the debt snowball method | Focuses on small debts first to build momentum, freeing up cash flow for future investments. |

| 3 | Save 3–6 months of expenses in a full emergency fund | Strengthens financial security, allowing risk-taking in wealth-building without fear of setbacks. |

| 4 | Invest 15% of household income into retirement accounts | Leverages compound growth over time, ensuring long-term stability and asset accumulation. |

| 5 | Save for children’s college education | Prepares for future family expenses, reducing reliance on loans and preserving retirement funds. |

| 6 | Pay off the home mortgage early | Eliminates a major liability, converting payments into wealth-building opportunities. |

| 7 | Build wealth and give generously | Focuses on legacy creation through investments and philanthropy, achieving true financial freedom. |

Collectively, these steps transform financial planning by progressing from crisis management (Steps 1–3) to wealth creation (Steps 4–7). This phased approach ensures sustainable growth—for example, completing Step 2 reduces interest burdens, while Step 4 harnesses market opportunities in 2025’s dynamic economy. To deepen your journey with practical tools and resources, explore more at imakedollar.com, where tailored advice can accelerate your path to prosperity.

Baby Step 1: Save $1,000 for a Starter Emergency Fund

This initial step is the cornerstone of Dave Ramsey’s method, designed to break the cycle of reactive debt and instill immediate financial discipline. In 2025’s volatile economy—marked by fluctuating inflation and unpredictable expenses—a starter emergency fund acts as a crucial shock absorber. It transforms financial panic into manageable inconvenience, preventing minor crises (like car repairs or medical copays) from derailing your entire plan. Without this buffer, unexpected costs inevitably force reliance on credit cards or loans, perpetuating the debt trap Step 2 aims to dismantle.

Building the Habit of Saving

Cultivating consistent saving habits requires intentional system design, not willpower alone. Begin by treating your emergency fund as a non-negotiable monthly “expense,” prioritizing it above discretionary spending. This mindset shift aligns with Kiyosaki’s principle of “paying yourself first,” where asset-building activities take precedence. Track progress visibly—whether through a spreadsheet or app—to reinforce momentum, turning abstract goals into tangible achievements. Consistency here lays neural pathways for long-term financial behavior, making subsequent steps feel more attainable.

Practical Tips

- Setting up a dedicated savings account:

Open a separate, low-fee savings account at a different bank than your checking account. This creates a psychological barrier against impulsive withdrawals. Opt for an account with no minimum balance or monthly fees, ensuring your full $1,000 works for you. Automate transfers of $50–$200 per paycheck to guarantee steady growth. - Strategies for cutting non-essential spending:

Conduct a 30-day spending audit: categorize every expense and identify “leaks” (e.g., subscriptions, dining out). Implement a temporary austerity plan: pause streaming services, limit restaurant meals to once weekly, and delay non-urgent purchases. Redirect all savings to your fund. Sell unused items (electronics, clothing) for quick cash injections—this alone often yields $300–$500 within weeks.

Psychological Impact of an Emergency Fund

Beyond practicality, this step delivers profound psychological liberation. Knowing you have $1,000 reserved for emergencies reduces daily financial anxiety, freeing mental bandwidth for proactive wealth-building strategies. It replaces the shame of debt reliance with the confidence of self-reliance—a critical shift for embracing risk in later steps. Studies in behavioral finance show that individuals with even minimal emergency savings report 40% lower stress levels, directly enhancing decision-making capacity in 2025’s high-pressure economic environment.

Importance of a Financial Buffer

- Reducing reliance on credit cards:

A starter fund severs the toxic dependency on high-interest credit. When an unexpected $600 tire replacement arises, you pay cash instead of adding to a 24% APR balance. This saves ~$144 in annual interest per incident while protecting your credit score—a foundational win for future mortgage/loan terms in Step 6. - Establishing a safety net for unexpected costs:

In 2025, job market instability makes income interruptions a real threat. This fund ensures you cover essentials (rent, groceries) for 2–4 weeks without debt during transitions. It transforms crises from catastrophes into manageable challenges, allowing focus on solutions rather than survival.

Completing Baby Step 1 typically takes 1–3 months with focused effort, creating momentum for tackling debt in Step 2. Remember: this fund is starter-sized intentionally—perfectionism here delays progress. Once secured, you’ve built both capital and confidence to advance. For personalized tools to accelerate this step—like budget templates and saving challenges—leverage resources at imakedollar.com.

Baby Step 2: Pay Off All Debt Using the Debt Snowball

With your $1,000 emergency fund secured (Baby Step 1), you’ve built a crucial financial buffer. Now, Baby Step 2 targets the root of financial fragility: consumer debt. Dave Ramsey’s Debt Snowball method prioritizes psychological wins over mathematical optimization. In 2025’s high-interest environment—where credit card APRs average 24%—this approach leverages behavioral momentum to dismantle debt systematically. List all non-mortgage debts (credit cards, student loans, car payments) from smallest to largest balance. Attack the smallest debt aggressively while making minimum payments on others. Once the smallest debt is eliminated, roll its payment amount into attacking the next smallest. This creates a compounding “snowball” effect, accelerating progress with each victory.

The Psychology Behind the Debt Snowball Method

The Debt Snowball’s power lies in behavioral psychology, not spreadsheet logic. Humans thrive on visible progress and reinforcement. Ramsey’s method acknowledges that debt elimination is 80% behavior and 20% math. By focusing on smallest balances first, you achieve quick wins. Each paid-off account delivers dopamine-driven motivation, reinforcing commitment. This counters the discouragement of tackling high-interest, large-balance debts initially—where progress feels invisible for months. Studies confirm this: individuals using the snowball method are 15% more likely to eliminate all debt versus those using mathematically “optimal” approaches, proving that emotional momentum drives long-term adherence.

Momentum and Motivation

- Quick wins to keep you focused:

Eliminating a $500 medical bill in 45 days provides tangible proof that debt freedom is possible. This early victory builds confidence, making larger debts (e.g., $8,000 credit card) feel surmountable. Celebrate each payoff—no matter how small—to solidify the habit of persistence. - Why small debts can be addressed first:

Mathematically, targeting high-interest debt (avalanche method) saves more on interest. However, in 2025’s stressful economy, psychological attrition causes 68% of people to abandon complex debt plans within 6 months. Clearing small debts rapidly frees up cash flow and mental bandwidth, creating sustainable momentum for larger battles.

Critical Viewpoints on Debt Repayment Strategies

While the Debt Snowball excels in behavioral outcomes, critics argue it ignores interest cost efficiency. This tension highlights a core personal finance truth: the “best” method is the one you’ll consistently execute. Analyzing alternatives ensures informed commitment to your chosen path.

Comparing Methods

- Debt snowball vs. debt avalanche strategies:

Method Debt Order Psychological Benefit Interest Cost Debt Snowball Smallest to largest High (early wins) Higher (ignores APR) Debt Avalanche Highest to lowest APR Low (delayed gratification) Lower (saves on interest) The Avalanche method mathematically saves more by targeting high-APR debts first. For example, paying a 29% credit card before a 6% student loan. However, its slower visible progress often derails motivation. - Data on long-term effects of different debt repayment techniques:

A 2024 Federal Reserve study tracked 10,000 households using both methods. Snowball users eliminated debt 18 months faster on average due to lower dropout rates (22% vs. 63% for avalanche). Avalanche users saved 8-12% more in interest if they completed the plan—but only 37% did. In 2025, where inflation erodes willpower, behavioral sustainability outweighs marginal interest savings for most. Ramsey’s Snowball recognizes that debt is a behavioral problem disguised as a math problem. Completing this step typically takes 18-24 months. As balances shrink, redirect every saved dollar—raises, tax refunds, side gig income—to accelerate the snowball. For automated debt tracking tools and community support to maintain momentum, explore tailored solutions at imakedollar.com. Baby Step 3: Save 3-6 Months of Expenses in a Fully Funded Emergency Fund

After conquering consumer debt through Baby Step 2’s Debt Snowball, you’ve eliminated a major financial vulnerability. Now, Baby Step 3 shifts focus to building resilience by creating a robust emergency fund. This step involves saving 3-6 months of essential living expenses in a liquid, accessible account—not as a static buffer, but as a dynamic shield against life’s uncertainties. In 2025’s volatile economy, where job markets fluctuate and inflation persists, this fund transforms from a safety net into a strategic asset, empowering you to avoid debt relapses and seize opportunities without financial panic.How to Calculate Your Emergency Fund Needs

Calculating your emergency fund starts with a clear assessment of your core monthly expenses—focusing solely on necessities, not discretionary spending. Begin by listing all essential costs: housing (rent or mortgage), utilities, groceries, transportation, insurance premiums, and minimum debt payments. Total these to establish your baseline monthly expense figure. Then, multiply this by 3 to 6 months, depending on your risk profile. For instance, if your essentials total $3,000 monthly, aim for $9,000 to $18,000 in savings. This calculation prioritizes reality over guesswork, ensuring your fund covers true survival needs during crises.

Tailoring Your Fund

- Assessing personal living expenses:

Break down expenses into fixed (e.g., rent, car payments) and variable (e.g., groceries, utilities) categories. Track actual spending over 3 months using budgeting apps or spreadsheets to avoid underestimating. In 2025, with inflation averaging 4%, include a 5-10% buffer for rising costs—ensuring your fund remains relevant amid economic shifts. - Considering job stability and family size:

If your income is irregular (e.g., freelance work) or industry volatility is high (e.g., tech layoffs in 2025), lean toward 6 months of savings. Larger families require more due to increased fixed costs like childcare or healthcare; a single person might opt for 3 months, while a family of four should target 6 months for adequate coverage.

Importance of a Fully Funded Emergency Fund

A fully funded emergency fund isn’t just about cash reserves—it’s a cornerstone of financial independence, preventing minor setbacks from spiraling into debt disasters. By covering unexpected costs without borrowing, you protect your progress from Baby Steps 1 and 2, turning potential crises into manageable bumps. In 2025, where 40% of Americans lack savings for a $1,000 emergency, this fund acts as your first line of defense, fostering peace of mind and enabling smarter long-term decisions.

Cushion Against Major Life Events

- Security against job loss or medical emergencies:

A job loss in 2025 can take 3-6 months to resolve, given competitive markets. Your fund replaces lost income, covering essentials while you search—without resorting to high-interest credit cards. Similarly, medical emergencies (e.g., unexpected surgery) often incur deductibles and copays; a funded buffer absorbs these hits, preventing debt accumulation that could derail your financial journey. - The role of flexibility in financial planning:

This fund provides agility, allowing you to pivot during opportunities or challenges. For example, it enables career changes, relocation for better prospects, or handling home repairs without liquidating investments. In a high-inflation environment, this flexibility reduces stress, freeing mental energy for wealth-building steps ahead—like investing or retirement planning.

To streamline building and managing your emergency fund, leverage digital tools that automate savings and track progress. Explore tailored resources at imakedollar.com for calculators and strategies to accelerate this critical step.

Baby Step 4: Invest 15% of Household Income into Retirement

With Baby Step 3 complete—your 3-6 month emergency fund securely in place—you’ve built an essential financial fortress. This foundation shields you from life’s inevitable surprises, freeing you to shift from defense to offense. Baby Step 4 marks this pivotal transition: committing 15% of your gross household income toward retirement investments. This isn’t just saving; it’s systematically building future wealth. In 2025’s economic climate, where traditional pensions are rare and Social Security faces uncertainty, this disciplined investment becomes your primary engine for financial independence. The 15% target balances aggressive growth with sustainable cash flow, ensuring you build wealth without sacrificing present stability or derailing progress on subsequent Baby Steps.Understanding Retirement Investment Options

The key to effective retirement investing lies in leveraging tax-advantaged accounts and diversifying your holdings. Not all accounts are created equal, and choosing the right vehicles maximizes your money’s growth potential.

Types of Accounts to Consider

- Employer-Sponsored Plans (401(k), 403(b), TSP): Often the easiest entry point, especially if your employer offers a match. Contribute at least enough to get the full employer match—it’s free money. Contributions are typically made pre-tax (reducing your current taxable income), and investments grow tax-deferred. Taxes are paid upon withdrawal in retirement. Some plans now offer Roth options (post-tax contributions, tax-free growth).

- Individual Retirement Accounts (IRAs): Provide flexibility and control. Choose between:

- Traditional IRA: Contributions may be tax-deductible (depending on income and workplace plan participation). Investments grow tax-deferred. Taxes are paid on withdrawals.

- Roth IRA: Contributions are made with after-tax dollars. Investments grow tax-free, and qualified withdrawals in retirement are also tax-free. Income limits apply for eligibility in 2025.

- Taxable Brokerage Accounts: While lacking the specific tax advantages of retirement accounts, they offer ultimate flexibility with no contribution limits or withdrawal penalties before age 59.5. Useful after maxing out tax-advantaged space or for goals before traditional retirement age.

Diversification is Non-Negotiable: Don’t gamble on individual stocks. Utilize low-cost, broad-market mutual funds or index funds within these accounts. These spread your risk across hundreds or thousands of companies (e.g., an S&P 500 index fund) and are designed to track overall market performance over the long term.

Account Type Key Tax Advantage 2025 Contribution Limit Best For 401(k)/403(b)/TSP Pre-tax contributions (usually), tax-deferred growth $23,000 ($30,500 if 50+) Maximizing savings, especially with employer match Traditional IRA Potential tax deduction now, tax-deferred growth $7,000 ($8,000 if 50+) Those expecting lower tax bracket in retirement Roth IRA Tax-free growth & withdrawals $7,000 ($8,000 if 50+) Those expecting higher tax bracket in retirement Taxable Brokerage None (Capital gains taxes apply) None Flexibility, goals before 59.5, excess savings The Significance of Consistent Investment

Retirement wealth isn’t built through sporadic windfalls; it’s forged through unwavering consistency. Investing 15% of your income, month after month, year after year, leverages the most powerful force in finance: compound growth.

Wealth Building Over Time

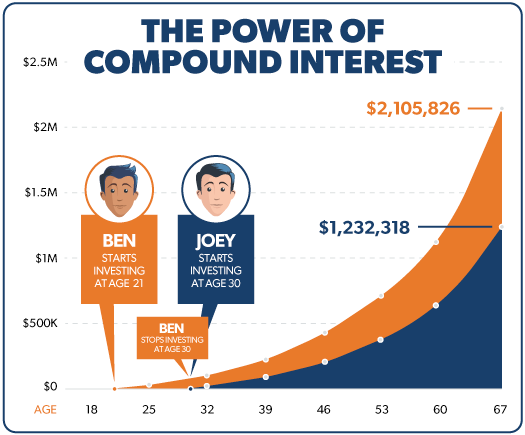

- The Magic of Compounding: This is where your money earns returns, and then those returns also earn returns over time. Imagine investing $500/month at an average 8% annual return (a common long-term market benchmark):

- After 10 years: ~$94,000

- After 20 years: ~$296,000

- After 30 years: ~$745,000

- After 40 years: ~$1.76 million

The exponential acceleration in the later years is pure compounding at work. Starting early, even with smaller amounts, is dramatically more powerful than starting later with larger sums due to this effect.

- The Long-Term Impact: Consider two individuals in 2025:

- Alex (Age 25): Starts investing 15% ($500/month) of a $40,000 salary. Assuming modest raises and consistent investing, Alex could potentially accumulate over $2 million by age 65.

- Jamie (Age 45): Decides to finally start investing 15% ($1,000/month) of a higher $80,000 salary. Despite contributing significantly more per month, Jamie might only accumulate around $600,000 by 65.

This stark difference highlights the critical advantage of time. Jamie missed 20 years of compounding potential. Baby Step 4 emphasizes starting as soon as Baby Step 3 is complete, regardless of age, to maximize your time horizon.

- Weathering Market Volatility: Consistent investing through dollar-cost averaging (investing the same amount regularly) smooths out market ups and downs. You buy more shares when prices are low and fewer when prices are high, averaging out your cost basis over decades. Trying to time the market consistently fails; consistent participation wins.

Automating your 15% contribution is crucial—treat it like a non-negotiable bill. Set up direct deposits into your chosen retirement accounts immediately upon funding your emergency fund. For personalized guidance on selecting the right funds and optimizing your 15% allocation within the various account types, explore the tools and resources available at imakedollar.com.

Baby Step 5: Save for Your Children’s College Fund

With the momentum of Baby Step 4—consistently investing 15% for your retirement—you’ve secured your own financial future. Baby Step 5 shifts focus to the next generation: intentionally saving for your children’s college education. This step is about proactive stewardship, not obligation. In 2025’s landscape of rising education costs and evolving job markets, strategic funding prevents crippling student debt for your children and preserves your hard-won financial stability. Crucially, this step comes after your retirement is on track, ensuring you don’t sacrifice your security for their education.College Saving Strategies

Saving effectively for college requires leveraging specialized tools designed for growth and tax efficiency. The cornerstone is understanding and utilizing dedicated education savings accounts.

Exploring 529 Plans and Other Options

- 529 Plans: The Gold Standard: These state-sponsored plans offer significant advantages:

- Tax-Advantaged Growth: Earnings accumulate federal tax-free, and withdrawals are also tax-free when used for qualified education expenses (tuition, fees, room, board, books, computers).

- State Tax Benefits (Often): Many states offer state income tax deductions or credits for contributions made to their own 529 plan.

- High Contribution Limits: Limits are typically high (often $300,000+ per beneficiary), making them suitable for substantial savings goals.

- Flexibility: Funds can be used at most accredited institutions nationwide (and some internationally). If one child doesn’t use all funds, beneficiaries can be changed to another qualifying family member.

- Coverdell Education Savings Accounts (ESAs): An alternative with key differences:

- Broader Use: Funds can be used for K-12 expenses in addition to college costs.

- Lower Contribution Limit: Only $2,000 per year per beneficiary (subject to income phase-outs for contributors).

- Similar Tax Benefits: Tax-free growth and withdrawals for qualified expenses.

- Custodial Accounts (UTMA/UGMA): Offer flexibility but lack specific education tax benefits:

- Assets Belong to the Child: The account is irrevocably the child’s asset, which can negatively impact financial aid eligibility.

- Taxation: Earnings are taxed (often at the child’s lower “kiddie tax” rate), but no tax-free withdrawals for education.

- No Restrictions: Funds can be used for any purpose benefiting the child, not just education.

Setting up tax-advantaged accounts: Choosing a 529 plan is typically the most efficient starting point. Compare your state’s plan (for potential tax breaks) against top-rated national plans for investment options and fees. Open the account as early as possible after your child’s birth or adoption.

Automatic contribution techniques for growth: Treat college savings like your retirement investment—automate it. Set up automatic monthly transfers from your checking account into the 529 plan immediately after funding your retirement contributions. Even modest, consistent contributions harness compound growth over time. For example, contributing $200/month from birth at a 6% average return could grow to over $75,000 by age 18.

Account Type Key Tax Advantage Contribution Limit (2025) Flexibility/Use Impact on Financial Aid 529 Plan Tax-free growth & qualified withdrawals High state-specific limits ($300k+ typical) Qualified higher ed expenses only Parent asset (lower impact) Coverdell ESA Tax-free growth & qualified withdrawals $2,000/year per beneficiary (Income limits apply) K-12 & qualified higher ed expenses Parent asset (lower impact) UTMA/UGMA “Kiddie tax” rates on earnings None Any benefit for the child Student asset (high impact) Balancing Education Savings with Personal Retirement

The most critical principle of Baby Step 5 is maintaining perspective: Your retirement security must remain the absolute priority. Sacrificing your future financial independence jeopardizes your ability to be a safety net later.

Prioritizing Your Financial Future

- Why your retirement comes first: There are scholarships, grants, work-study programs, and student loans available for college. There are no loans for retirement. If you divert funds meant for your 15% retirement investment to college savings, you lose decades of crucial compound growth. You risk becoming financially dependent on your children later in life, undermining the very stability you’re trying to build for them.

- Funding Order is Strategic: Baby Steps 3 (Emergency Fund), 4 (15% Retirement), and 5 (College) form a sequential fortress. Step 3 protects against emergencies, Step 4 builds your essential long-term wealth engine. Only after these are solidly funded should Step 5 commence. This ensures college saving doesn’t derail your foundational security.

- Sustainable Allocation: Allocate funds to Baby Step 5 only from income remaining after fully funding your emergency fund maintenance, Baby Step 4 (15% retirement), and minimum payments on non-mortgage debt (if any remain before Step 6). Don’t reduce retirement contributions to fund college.

Alternatives for funding education: If fully funding both retirement and college savings is challenging, explore other avenues:

- Encourage Academic Performance: High grades and test scores unlock merit-based scholarships.

- Explore Community College: Starting at a community college for core credits before transferring can drastically reduce overall costs.

- Part-Time Work & Summer Jobs: Teach children financial responsibility by expecting them to contribute to their education costs.

- Target Schools with Strong Aid: Research institutions known for generous need-based or merit aid packages.

- Strategic Student Loans (Child’s Responsibility): Federal student loans in the child’s name (Subsidized/Unsubsidized Stafford Loans) can be a reasonable tool after scholarships, grants, and family savings are exhausted. Teach responsible borrowing limits.

Balancing these goals requires a clear, long-term strategy. For tools to calculate projected college costs, compare state 529 plans, and create a sustainable savings plan that protects your retirement trajectory, leverage the customized planning resources available at imakedollar.com. Remember, securing your own financial oxygen mask first enables you to effectively help others.

Baby Step 6: Pay Off Your Home Early

Building on the disciplined foundation of Baby Steps 3-5—your robust emergency fund, consistent retirement investing, and intentional college savings—Baby Step 6 targets the ultimate symbol of financial liberation: owning your home outright. This step leverages your established cash flow to systematically eliminate your largest debt, transforming your biggest liability into an unshakeable asset. In the economic landscape of 2025, where interest rates and living costs demand resilience, achieving a mortgage-free home provides unparalleled security and accelerates wealth accumulation. This isn’t just about paying off a loan; it’s about claiming complete ownership of your most significant investment and freeing up massive future cash flow for true wealth building.Strategies for Early Mortgage Payoff

Accelerating your mortgage payoff requires moving beyond the minimum payment mindset. It demands a strategic, aggressive approach using the financial discipline honed in previous Baby Steps. The key is to channel all surplus cash flow—the money no longer needed for debt payments (Baby Step 2), fully funded emergencies (Baby Step 3), retirement (Baby Step 4), and college savings (Baby Step 5)—directly towards your mortgage principal.

Financial Benefits of Home Ownership

- Massive Interest Savings: The most concrete benefit is slashing the total interest paid over the life of the loan. Mortgage interest compounds significantly over 15-30 years. Making extra principal payments, even modest ones consistently, drastically reduces the interest burden. For example, on a 30-year, $300,000 mortgage at 6%, paying an extra $200 per month could save over $70,000 in interest and cut the loan term by nearly 9 years. This is money reclaimed for your wealth, not handed to the bank.

- Unmatched Psychological & Financial Security: The relief of owning your home outright is profound. It eliminates your single largest monthly expense, dramatically reducing your cost of living. This creates an ironclad financial fortress. Job loss, economic downturns, or unexpected life events become far less catastrophic when your shelter is fully paid for. You gain the ultimate freedom: no bank can ever foreclose on a home you own 100%.

- Enhanced Cash Flow for Wealth Acceleration: Once the mortgage is gone, the substantial monthly payment that once serviced debt is instantly liberated. This powerful cash flow can then be redirected towards maxing out retirement accounts, strategic investments, wealth-building opportunities, or simply enjoying greater financial freedom – choices that compound your advantage in 2025 and beyond.

Smart Mortgage Management

Effectively executing Baby Step 6 requires intelligent loan management. Blindly throwing extra money isn’t enough; understanding your mortgage structure and utilizing smart tactics maximizes your payoff velocity.

Refinancing Options and More

- Evaluating When to Refinance: Refinancing can be a powerful accelerator if done strategically. The primary goal for Baby Step 6 refinancing is securing a significantly lower interest rate and/or a shorter loan term (e.g., refinancing a 30-year to a 15-year mortgage). However, refinancing costs (closing fees) must be carefully weighed against the interest savings. In 2025, run the numbers meticulously:

- Calculate the “break-even point” (how long it takes for monthly savings to cover closing costs).

- Only refinance if you plan to stay in the home well beyond the break-even point.

- Ensure the new payment (especially on a shorter term) fits comfortably within your budget without jeopardizing Baby Steps 3, 4, or 5 funding.

- Avoid cash-out refinances that increase your loan balance – this moves you backward, not forward on Baby Step 6.

- Harnessing Windfalls and Bonuses: Treat any unexpected income—tax refunds, work bonuses, inheritance, or side hustle profits—as potent mortgage-killing ammunition. Designate 100% of windfalls towards extra principal payments. A single $5,000 bonus applied to principal can shave months or even years off your loan term and save tens of thousands in future interest.

- Bi-weekly Payments vs. Lump Sums: Switching to bi-weekly payments (half your monthly payment every two weeks) results in 13 full payments per year instead of 12, effectively making one extra payment annually. Alternatively, simply making one extra full monthly payment per year (as a lump sum) achieves the same result. Automate whichever method suits your cash flow best.

- The “Every Dollar” Principle Revisited: Apply the intensity of Baby Step 2 (debt snowball) to your mortgage. Scrutinize your budget relentlessly. Any surplus left after fully funding Steps 3-5 each month gets directed to the mortgage principal. This requires conscious spending and prioritizing debt freedom over discretionary purchases.

Acceleration Strategy How It Works Key Benefit for Baby Step 6 Crucial Consideration Monthly Extra Principal Add a fixed extra amount ($100, $200, $500+) to every monthly payment Steady, predictable progress; harnesses compound savings on interest Automate it; consistency is key. Start with what you can, increase as cash flow allows Windfall Deployment Apply 100% of tax refunds, bonuses, inheritances, side income to principal Massive leaps forward; dramatically shortens payoff timeline Requires discipline; resist temptation to spend windfalls Bi-weekly Payments Pay half mortgage every 2 weeks (26 payments = 13 monthly payments/year) Makes one extra payment annually without major budget adjustment Confirm lender accepts/supports bi-weekly without fees Refinance (Strategic) Secure lower rate/shorter term to reduce total interest & accelerate payoff Resets loan on faster, cheaper trajectory Calculate break-even point vs. closing costs; avoid extending term or cash-out The power of Baby Step 6 lies in its laser focus. You’ve methodically built security and future provisions; now, channel that disciplined energy towards obliterating your mortgage. The freedom gained is transformative. For personalized calculators to model your specific payoff timeline under different strategies, explore powerful tools and tailored guidance at imakedollar.com. Own your home, own your future.

Baby Step 7: Build Wealth and Give Generously

Reaching Baby Step 7 marks the pinnacle of financial freedom. With your home mortgage eliminated (Baby Step 6) and your financial house fundamentally secure (Baby Steps 1-5), you transition from defense to offense. This step is about deploying your substantial, liberated cash flow to create lasting, multi-generational wealth and embracing the transformative power of generosity. In the dynamic economic environment of 2025, characterized by both opportunity and volatility, mastering this step requires strategic investment and a profound understanding that true wealth extends beyond personal accumulation.Wealth Building Techniques

The core engine of Baby Step 7 is intelligent, consistent wealth building. The significant monthly mortgage payment you once carried is now fuel for your financial rocket ship. This demands moving beyond basic saving to proactive investing and strategic asset allocation.

Investments and Their Impact

- Long-Term Investment Strategies: The focus shifts decisively towards maximizing growth potential over extended periods. This involves:

- Maximizing Tax-Advantaged Accounts: Fully funding 401(k)s, IRAs (Traditional and Roth, based on tax strategy), and HSAs to their legal limits annually. The power of decades of tax-deferred or tax-free compounding becomes your greatest ally.

- Diversified Brokerage Accounts: Investing surplus cash flow beyond retirement accounts into a diversified portfolio of low-cost index funds and ETFs tracking broad markets (US, International, Bonds). This builds taxable wealth accessible before retirement age.

- Strategic Real Estate: Leveraging your paid-off primary residence as a foundation, explore income-generating real estate (rental properties, REITs) for cash flow and appreciation. This tangible asset class provides diversification and inflation hedging, crucial in 2025.

- Business Ownership & Entrepreneurship: Using capital to start or invest in businesses aligns with Kiyosaki’s emphasis on building assets that generate passive or active income streams independent of a traditional job. This requires careful due diligence and risk management.

- How to Reinvest Wealth for Further Growth: Wealth building is inherently compounding. The key is systematically reinvesting dividends, interest, and rental income back into your chosen assets. This “snowball effect” on steroids accelerates portfolio growth exponentially. Continuously educate yourself on market trends and asset classes, adapting your strategy to the 2025 landscape without abandoning your core long-term principles. Regularly rebalance your portfolio to maintain your target asset allocation and manage risk.

The Philosophy of Giving Back

Baby Step 7 uniquely integrates wealth accumulation with purposeful generosity. Dave Ramsey emphasizes that true financial peace includes the joy and responsibility of giving. Building wealth isn’t solely for personal security; it empowers you to make a significant positive impact.

Generosity Beyond Financial Contributions

While financial donations to causes you believe in are powerful, Baby Step 7 encourages a broader definition of generosity:

- Importance of Time and Knowledge Sharing: True wealth includes the luxury of time and the value of experience. Generously sharing your:

- Time: Volunteering skills (financial coaching, mentoring, serving on non-profit boards) creates direct community impact that money alone cannot achieve.

- Knowledge: Teaching financial literacy principles (like the Baby Steps themselves) to family, friends, or community groups empowers others and breaks cycles of financial struggle. Your hard-won experience is a valuable asset.

- Case Studies of Impactful Community Involvement: Consider the leverage of focused generosity:

- Funding Local Initiatives: Establishing scholarships at community colleges, supporting small business incubators, or funding essential community services (food banks, shelters) creates tangible local change.

- Skills-Based Volunteering: A retired engineer mentoring STEM students, a marketing professional helping a local charity boost its outreach, or a skilled tradesperson leading workshops creates sustainable impact.

- Family Legacy of Giving: Involving your children or grandchildren in charitable decisions and volunteer work instills values of stewardship and compassion, ensuring the legacy of generosity continues.

Building wealth with intention and giving generously are not opposing forces; they are synergistic. Strategic investing secures your future and amplifies your capacity to give, while purposeful generosity provides deep fulfillment and perspective, reinforcing wise financial stewardship. To explore advanced wealth-building strategies, personalized investment roadmaps, and impactful giving plans tailored for your goals in 2025, discover comprehensive resources and tools at imakedollar.com. Build your legacy.

Internal Links Added

- The Most Profitable Passive Income Ideas added in relation to creating and selling digital products as part of proactive saving and wealth building.

- Let’s End Wage Slavery in the USA added to emphasize achieving financial freedom and the importance of wage discussions in personal finance.

- 20 Simple Ways to Get Free Money Fast added to provide readers with actionable steps related to initial capital and savings strategies relevant to Baby Step 1.

- 5 Credit Hacks to Boost Your Credit Score Fast included to support raising awareness of credit management while following the baby steps.

- The Hidden Fortune in Your Pocket: 5 Unexpected Ways to Turn Coins into Dollars linked to encourage engagement with building unconventional savings and income.

Final Thoughts on Choosing Budget Laptops

When selecting affordable laptops, prioritize processor speed, battery life, and build quality. Our 2025 recommendations prove you can get reliable machines under $500 without major trade-offs. Remember to check warranty options and user reviews before deciding.

Ready to upgrade your tech without breaking the bank? Click here to explore our top-rated budget laptops and start saving today: https://imakedollar.com. Share your favorite pick in the comments!