Did you know 68% of retirees underestimate healthcare costs by age 85? Proper retirement planning requires calculating lifestyle expenses and tax-efficient withdrawals. Start your 2025 strategy today!

【Start With Your Retirement Vision】

Why Lifestyle Costs Dictate Savings Targets

Travel & Hobby Expenses Often Surprise Retirees

The allure of retirement often centers on freedom – freedom to travel, pursue hobbies, and enjoy long-deferred passions. However, many retirees significantly underestimate the ongoing costs associated with these activities. Real-world examples, like one commenter detailing a planned $5,000 annual travel budget plus a dedicated $300/month “fun money” fund for hobbies and leisure, highlight the concrete financial implications. These aren’t frivolous extras; they are core components of the envisioned retirement lifestyle. Failing to account for them before retirement leads to budget shortfalls and forced compromises later. Accurately projecting these costs is paramount for determining your necessary savings rate and portfolio size.

Balancing Essential vs. Aspirational Spending

Crafting a sustainable retirement plan requires a clear-eyed separation between non-negotiable expenses (housing, food, utilities, basic transportation, insurance) and aspirational spending (travel, hobbies, dining out, gifts). This distinction is crucial because:

- Essential costs form your baseline survival budget. Your savings must cover these, adjusted for inflation, for your entire lifespan.

- Aspirational spending defines your desired quality of life. This is where flexibility exists; scaling these costs up or down directly impacts the savings target needed.

- Prioritization is key. Understanding which aspirations are “must-haves” versus “nice-to-haves” allows for strategic planning and potential adjustments if savings fall short.

Healthcare Costs Spike at Age 70+ (Data Required)

Perhaps the most critical, and often underestimated, expense category in later retirement is healthcare. While Medicare provides essential coverage starting at age 65, significant out-of-pocket costs remain, and they tend to escalate dramatically as individuals enter their 70s and beyond due to increased utilization of services and long-term care needs. Crucially, Medicare Part B (medical insurance) and Part D (prescription drug) premiums are directly tied to your Modified Adjusted Gross Income (MAGI) from two years prior.

Here’s how Medicare Premiums Increase Based on Income (Using 2025 Projected Brackets):

| Individual MAGI (2023 for 2025 Premiums) | Joint MAGI (2023 for 2025 Premiums) | Monthly Part B Premium (Est. 2025) | Monthly Part D Surcharge (Est. 2025) |

|---|---|---|---|

| ≤ $103,000 | ≤ $206,000 | ≈ $174.70 (Standard) | $0.00 |

| > $103,000 to ≤ $129,000 | > $206,000 to ≤ $258,000 | ≈ $244.60 (IRMAA Tier 1) | ≈ $12.90 |

| > $129,000 to ≤ $161,000 | > $258,000 to ≤ $322,000 | ≈ $349.40 (IRMAA Tier 2) | ≈ $33.30 |

| > $161,000 to ≤ $193,000 | > $322,000 to ≤ $386,000 | ≈ $454.20 (IRMAA Tier 3) | ≈ $53.80 |

| > $193,000 to < $500,000 | > $386,000 to < $750,000 | ≈ $559.00 (IRMAA Tier 4) | ≈ $74.20 |

| ≥ $500,000 | ≥ $750,000 | ≈ $594.00 (IRMAA Tier 5) | ≈ $81.00 |

Source: Projections based on current Medicare IRMAA structure and inflation trends for 2025. Key Takeaways:

- Income Matters: Withdrawals from tax-deferred accounts (like Traditional IRAs/401(k)s) directly increase your MAGI, potentially pushing you into higher premium brackets two years later.

- Costs Accelerate with Age: Beyond premiums, expect rising costs for copays, deductibles, dental, vision, hearing (not covered by traditional Medicare), and potentially long-term care insurance or out-of-pocket care costs. A 2025 projection might estimate average annual out-of-pocket healthcare costs for a healthy 65-year-old couple at around $8,000, potentially tripling or more by their mid-80s.

- Plan for the Surge: Your retirement savings strategy must explicitly factor in this significant cost increase phase. Relying solely on early-retirement healthcare cost estimates is a dangerous oversight.

Mapping out your desired retirement vision requires confronting these financial realities head-on. Understanding the true cost of your lifestyle aspirations and the unavoidable surge in healthcare expenses later in retirement is the bedrock of effective planning. Tools like those available at https://imakedollar.com can help model different scenarios, incorporating inflation and these specific cost escalations, to give you a clearer picture of your needed savings target for 2025 and beyond.

【Master Tax-Efficient Withdrawal Order】

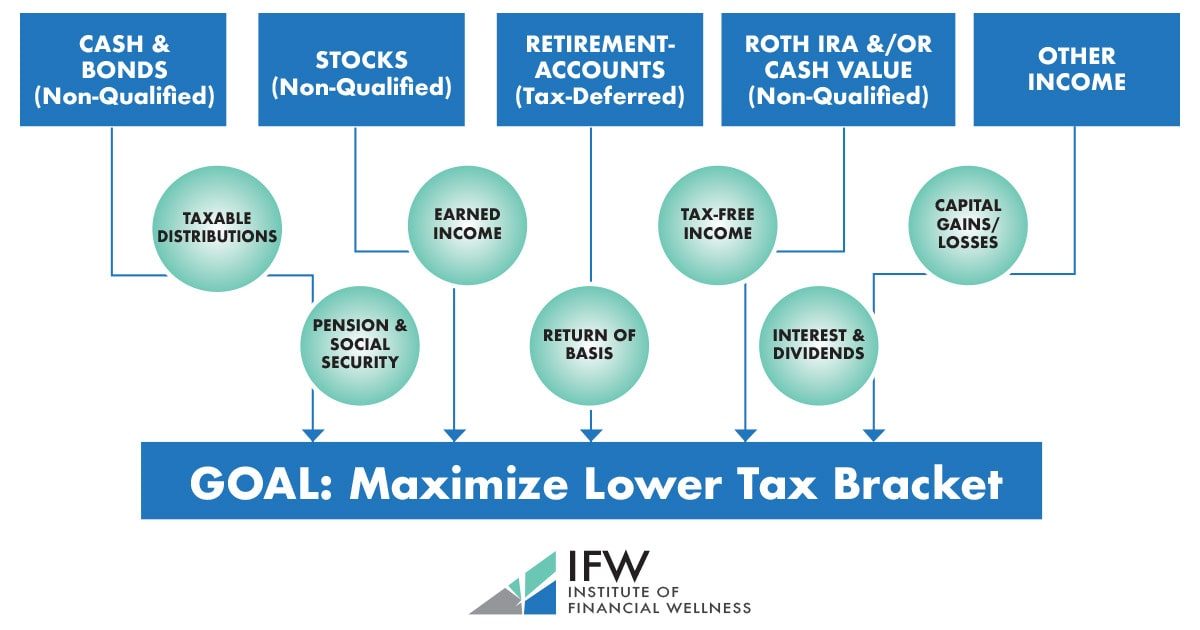

The Critical 3-Bucket Strategy

Retirement savings often reside in three distinct “buckets,” each with unique tax rules governing withdrawals: Taxable Brokerage Accounts, Tax-Deferred Accounts (Traditional IRAs, 401(k)s, 403(b)s), and Tax-Free Accounts (Roth IRAs, Roth 401(k)s). The order in which you tap these buckets during retirement has profound implications for your tax bill, Medicare premiums, and the longevity of your savings. A deliberate withdrawal sequence is not just beneficial; it’s essential for preserving your wealth.

Traditional IRA/401k Withdrawal Pitfalls

Tax-deferred accounts offer upfront tax deductions but impose significant constraints and costs upon withdrawal:

- Premature Access Penalty: Withdrawals before age 59½ generally incur a 10% early withdrawal penalty on top of ordinary income tax. This double hit can devastate savings intended for later years.

- Mandatory Distributions: Starting at age 73 (for those reaching 73 after Dec 31, 2022), Required Minimum Distributions (RMDs) force you to withdraw a percentage annually, whether you need the money or not. This can push you into higher tax brackets and increase Medicare Part B & D premiums via IRMAA surcharges.

- Tax Timing Risk: Every dollar withdrawn is taxed as ordinary income. Large withdrawals, especially when combined with RMDs or other income, can unexpectedly bump you into a higher 2025 federal tax bracket (e.g., 22% or 24%) and trigger those costly IRMAA tiers discussed earlier.

Roth IRA: Your Tax-Free Emergency Fund & Strategic Asset

Roth accounts function fundamentally differently, offering crucial flexibility:

- Contributions Withdrawable Anytime: You can withdraw your original Roth IRA contributions (not earnings) at any age, tax-free and penalty-free. This makes Roth funds a powerful source for unexpected expenses without triggering taxes or penalties.

- Tax-Free Qualified Distributions: After age 59½ and holding the account for at least 5 years, both contributions and earnings can be withdrawn completely tax-free. This shields you from future tax rate increases.

- No RMDs During Owner’s Lifetime: Unlike Traditional IRAs, Roth IRAs have no lifetime RMDs, allowing the funds to continue growing tax-free for longer or to be preserved for heirs.

- IRMAA Shield: Roth withdrawals do not count as taxable income. Using Roth funds strategically helps keep your MAGI low, potentially avoiding higher Medicare premiums in future years.

Why Sequence Beats Account Balance

Having a large nest egg is only half the battle. Withdrawing funds inefficiently can erode it far faster than necessary due to unnecessary taxes and penalties. The optimal sequence generally prioritizes flexibility and tax minimization:

- Taxable Brokerage Accounts First (Generally): Draw from regular investment accounts first. Long-term capital gains rates (0%, 15%, or 20% in 2025) are often lower than ordinary income tax rates applied to Traditional IRA/401(k) withdrawals. This helps keep your ordinary income low in early retirement.

- Tax-Deferred Accounts (Traditional IRA/401k) Strategically: Tap these next, but carefully manage the amount withdrawn each year. Aim to stay within a lower tax bracket (e.g., 12% in 2025) and below IRMAA thresholds. Delay large withdrawals if possible until after starting Social Security, but be mindful of RMDs forcing your hand later.

- Tax-Free Accounts (Roth IRA) Last: Preserve Roth funds as long as possible. Use them for large, unexpected expenses without tax consequences, to cover spending needs in high-income years without increasing your tax burden, or to leave a tax-free inheritance. Their tax-free growth potential is maximized the longer they remain untouched.

Case Study: $1.2M Saved But Wrong Withdrawal Order

Consider two retirees, both with $1.2M total saved in 2025 ($400k Taxable, $600k Traditional IRA, $200k Roth IRA). Both need $70,000 net after-tax income this year. Their withdrawal choices lead to starkly different tax outcomes:

-

Poor Strategy (Ignores Sequence & Tax Brackets):

- Withdraws entire $70k needed from Traditional IRA.

- Consequence: The $70k is taxed as ordinary income. After the 2025 standard deduction (~$14,700 single), taxable income is ~$55,300. This pushes them well beyond the 12% bracket limit ($47,150 estimated for 2025 single filer) into the 22% bracket. They pay significant federal income tax and potentially trigger IRMAA surcharges in 2027 based on this high 2025 MAGI. Their $70k withdrawal results in only ~$57k net after federal tax.

-

Optimized Strategy (Uses 3-Bucket Sequence):

- Withdraws $25k from Taxable Account (assume $15k basis, $10k long-term gain). Taxed at 0% LTCG rate (stays below $47,025 LTCG threshold for 0% in 2025).

- Withdraws $35k from Traditional IRA. After standard deduction, taxable ordinary income is ~$20,300, staying entirely within the 12% tax bracket.

- Withdraws $10k from Roth IRA (Contributions). Tax-free and penalty-free.

- Result: Achieves $70k net income with minimal tax burden. Federal tax is primarily just 12% on the $35k Traditional withdrawal (minus portion covered by deduction). MAGI is kept much lower ($35k Traditional + $10k LTCG = $45k), reducing future IRMAA risk. Savings in other buckets continue growing tax-advantaged.

The difference? Thousands saved in immediate taxes, protection from higher Medicare premiums, and significantly more money preserved for future years. This underscores why the order of withdrawals demands as much attention as the account balances themselves. Modeling your specific scenario with tools like those at https://imakedollar.com is vital to avoid costly missteps and ensure your hard-earned savings last.

【Optimize Retirement Accounts】

401k vs. IRA: Where to Focus First

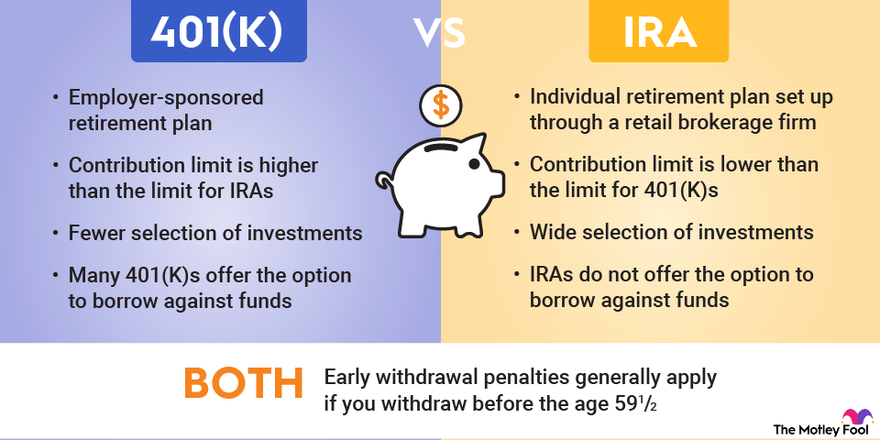

When building retirement savings, prioritizing where to allocate funds is critical. Workplace 401(k)s and Individual Retirement Accounts (IRAs) serve distinct purposes, each with unique advantages:

| Feature | 401(k) | Traditional/Roth IRA |

|---|---|---|

| Contribution Limit (2025) | $23,000 ($30,500 if age 50+) | $7,000 ($8,000 if age 50+) |

| Income Limits | None for contributions | Roth IRA: Phase-outs start at MAGI ~$146k (single)/$230k (married) |

| Investment Options | Limited to employer-selected menu | Broad range (stocks, bonds, ETFs, mutual funds) |

| Creditor Protection | Strong ERISA protection | Varies by state (typically strong) |

| Loan Options | Often permitted (up to $50k or 50% of balance) | Not permitted |

Employer Match Is Non-Negotiable Free Money

The most compelling reason to prioritize your 401(k) is capturing your full employer match. This is an instant, risk-free return on your contributions that no other account can match:

- Typical Structure: Employers commonly match 50-100% of your contributions up to 3-6% of your salary. Example: A $60,000 salary with a 100% match on 5% means contributing $3,000 earns you an additional $3,000 free.

- Vesting: Funds become fully yours after a set period (e.g., 20% per year over 5 years). Always understand your plan’s schedule.

- Action: Contribute at least enough to get the full match before funding an IRA. Missing this is equivalent to declining a guaranteed 50-100% return.

Roth Conversions Before RMDs Kick In

Tax-deferred accounts (Traditional IRA, 401(k)) face a looming deadline: Required Minimum Distributions (RMDs) starting at age 73 (for those born after 1960). Roth conversions—transferring funds from a Traditional account to a Roth IRA—before this age can strategically reduce future tax burdens:

- Tax Payment: You pay ordinary income tax on the converted amount in the year of conversion.

- Future Benefit: Converted funds grow tax-free in the Roth and face no RMDs during your lifetime. Qualified withdrawals (after 59½ & 5-year holding) are tax-free.

- Heir Advantage: Roth IRAs generally allow heirs tax-free withdrawals over 10 years, unlike inherited Traditional IRAs which require taxable distributions.

Tax Bracket Targeting Before Age 72

The key to successful Roth conversions is strategic timing and amount control before RMDs inflate your taxable income:

- Identify Low-Income Years: Target periods between retirement and age 72 when your income is lower (e.g., after stopping work but before Social Security/RMDs start).

- “Fill” Your Bracket: Convert amounts that push your income to the top of your current tax bracket without jumping into the next one. For 2025:

- Single Filers: Convert up to $47,150 (estimated top of 12% bracket).

- Married Filing Jointly: Convert up to $94,300 (estimated top of 12% bracket).

- IRMAA Avoidance: Keep your Modified Adjusted Gross Income (MAGI) below IRMAA thresholds ($103k single/$206k married in 2025) to prevent Medicare premium surcharges two years later. Partial conversions help manage this.

- Long-Term Savings: While you pay tax now, you permanently remove those funds (and their future growth) from the RMD calculation, lowering lifetime taxes and IRMAA exposure. Modeling conversion scenarios using tools like those at https://imakedollar.com is essential to maximize savings.

【Investment Strategies That Last】

Avoiding Extreme Portfolio Allocations

While optimizing where you save is crucial (as discussed in the prior section on 401(k)s and IRAs), deciding how you invest within those accounts is equally vital for long-term retirement security. Extreme portfolio allocations – either 100% stocks or 100% bonds – introduce significant risks that can derail decades of savings, especially near or during retirement.

100% Stocks Risk: Sequence of Returns Danger

A portfolio entirely in stocks offers high growth potential but exposes retirees to devastating “sequence of returns risk.” This refers to the danger of experiencing significant market losses early in retirement when you are withdrawing funds. Selling assets at depressed prices locks in losses and drastically reduces the portfolio’s longevity.

- Real-World Impact: Consider the 2008 financial crisis. A retiree starting withdrawals in 2008 with a 100% stock portfolio could have seen their balance drop by 30% or more in the very first year of retirement. This forced them to sell more shares just to generate the same income, severely impairing the portfolio’s ability to recover even if markets rebounded later.

- The Math: A large initial loss requires an exponentially larger subsequent gain just to break even. Recovering from a 30% loss requires a 43% gain. For a retiree drawing income, this math becomes unsustainable quickly.

100% Bonds Risk: Inflation Erosion

Conversely, a portfolio entirely in bonds prioritizes stability but carries a different, often underestimated threat: inflation erosion. Bonds provide fixed income, meaning their purchasing power steadily declines if inflation outpaces their returns. Over a long retirement horizon, this can be catastrophic.

- The Silent Thief: Assume a constant 3% annual inflation rate – a reasonable long-term average. This seemingly modest rate halves the purchasing power of your fixed bond income in approximately 24 years. A retiree at 65 relying solely on bonds could see their real income cut in half by age 89, precisely when healthcare costs often surge.

- Current Reality: Periods of higher inflation, like those experienced recently, dramatically accelerate this erosion, making an all-bond strategy particularly vulnerable.

Low-Cost ETF Advantage Over Mutual Funds

Once you’ve established an appropriate, diversified asset allocation (avoiding the extremes above), minimizing investment costs becomes the next critical lever for maximizing retirement income. Low-cost Exchange-Traded Funds (ETFs) consistently outperform higher-cost mutual funds over the long term, primarily due to their significantly lower expense ratios.

Fee Impact: 1% Fee = 28% Less Retirement Income

The compounding effect of fees over decades is staggering. A seemingly small difference in annual expense ratios translates into a massive difference in the final portfolio value and sustainable retirement income.

-

Vanguard Study Insight: Research consistently shows the long-term drag of high fees. A seminal Vanguard analysis demonstrated that over a 30-year investment horizon, paying a 1% annual fee instead of a 0.25% fee could reduce your potential retirement income by approximately 28%. This means paying $100,000 more in fees could cost you nearly $300,000 in lost retirement income.

-

Why ETFs Shine: ETFs typically have much lower expense ratios than actively managed mutual funds and often lower than comparable index mutual funds. They also tend to be more tax-efficient due to their unique creation/redemption process, generating fewer capital gains distributions.

-

Comparison at a Glance:

Feature Low-Cost ETF Typical Actively Managed Mutual Fund Avg. Expense Ratio 0.03% – 0.20% 0.50% – 1.50%+ Tax Efficiency High (In-kind creation/redemption) Lower (Forced capital gains distributions) Trading Intraday (like a stock) End-of-day price Minimum Investment Share price (often low) Often $1,000 – $3,000+

Focusing on broad-market, low-cost index ETFs for core holdings provides essential diversification and keeps more of your returns compounding for you, not paid out in fees. Regularly reviewing and optimizing the fees within your 401(k) and IRA holdings is a powerful, controllable factor in building lasting retirement wealth. Tools available at https://imakedollar.com can help model the long-term impact of fees on your specific retirement projections.

【Government Benefit Optimization】

Maximizing guaranteed income sources like Social Security and pensions is foundational to retirement security. These benefits form your financial bedrock, making strategic optimization essential.

Social Security Timing Strategies

Your claiming age dramatically impacts lifetime benefits and survivor income. While filing at 62 provides immediate cash flow, it permanently reduces monthly payments by up to 30% compared to Full Retirement Age (FRA). Conversely, delaying past FRA boosts benefits by 8% annually until age 70.

Breakeven Analysis: Claiming at 62 vs. 70

The “break-even point” – when cumulative higher benefits from delaying surpass total benefits collected by claiming early – typically occurs around age 80. Consider these 2025 projections:

| Claiming Age | Monthly Benefit | Total by Age 77 | Total by Age 85 | Survivor Benefit |

|---|---|---|---|---|

| Age 62 | $1,800 | $324,000 | $496,800 | Reduced base amount |

| Age 70 | $3,200 | $268,800 | $576,000 | Full $3,200 |

- Longevity is Key: Delaying requires living beyond approximately 80 for cumulative benefits to exceed early claiming. Health, family history, and current savings are critical factors.

- Spousal & Survivor Impact: Delaying maximizes the higher earner’s benefit, which becomes the survivor benefit. Claiming early permanently reduces this protection.

- Tax Efficiency: Higher benefits may increase taxable income, potentially impacting Medicare premiums (IRMAA) and overall tax liability.

Avoiding Pension Planning Oversights

Pensions, especially for public servants like law enforcement, military, teachers, and firefighters, have unique complexities often overlooked.

Law Enforcement/Military Pension Nuances

- Early Retirement, Lower Multipliers: Many public safety roles retire at 45-55 with pensions based on 1.5%-3% per year of service of final average salary. A 25-year veteran at 50 might receive only 50-75% of final pay, creating a long income gap before Social Security eligibility.

- The COLA Gap: Many public pensions lack full inflation adjustments (COLAs) or cap them (e.g., max 2-3%). A $4,000/month pension at age 50 could have the purchasing power of just $2,000 by age 75 with 3% inflation.

- Survivor Benefit Trade-offs: Electing a 100% joint survivor option significantly reduces the initial monthly payout. Failing to elect adequate survivor protection risks leaving a spouse with drastically reduced income.

- Lump Sum vs. Annuity: Taking a lump sum shifts longevity and investment risk entirely to the retiree. While offering flexibility, it requires sophisticated management to ensure lifetime income, especially considering early retirement ages.

- Health Insurance Linkage: Retiree health benefits are often tied to pension plans and eligibility rules. Early retirement before Medicare eligibility may require costly private coverage if employer subsidies are reduced or unavailable.

Optimizing these complex, often irrevocable decisions requires personalized analysis. Factors like marital status, spouse’s benefits, other retirement income sources, and health projections are crucial. Tools like the pension calculator and Social Security optimizer at https://imakedollar.com can help model scenarios specific to your public service pension details and claiming strategy.

【Dodge Costly Retirement Mistakes】

Moving beyond optimizing guaranteed income, proactive management of your retirement assets is equally critical. Common pitfalls can silently erode decades of savings, making awareness and strategic adaptation non-negotiable.

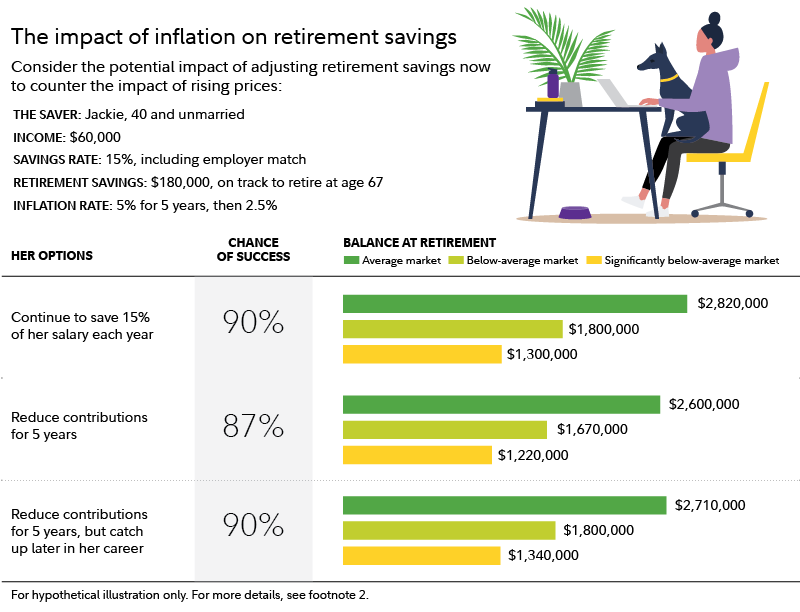

The 4% Rule Isn’t One-Size-Fits-All

The classic “4% rule” – withdrawing 4% of your initial portfolio annually, adjusted for inflation – provides a starting point but fails as a rigid strategy. Market volatility, sequence-of-returns risk (poor returns early in retirement), and personal spending needs demand flexibility. Blindly adhering to 4% can deplete portfolios prematurely during bear markets or force unnecessarily frugal living during bull markets.

Flexible Withdrawal Rates Beat Rigid Percentages

A dynamic approach significantly enhances sustainability and lifestyle quality. This means:

- Reducing Withdrawals During Downturns: Cutting withdrawals by 5% or more during significant market declines (e.g., 2025 bear markets) preserves capital, allowing it to recover. For a $1 million portfolio, this might mean taking $38,000 instead of $40,000.

- Rebounding During Bull Markets: When markets perform strongly, increasing withdrawals up to 6% allows you to enjoy the fruits of recovery. Using the same portfolio, this could mean $60,000 instead of sticking rigidly to $40,000 (adjusted for inflation).

- Regular Portfolio Reviews: Annual or biennial reassessments based on portfolio performance, inflation, and life changes (health, travel goals) are essential. A static rule ignores these evolving realities.

Underestimating Longevity Risk

Planning for an “average” lifespan is a recipe for potential disaster. Underestimating how long you’ll live is arguably the most dangerous retirement planning error, directly impacting how much you need to save and how carefully you must spend.

Planning to Age 95 vs. 85 Changes Savings Needs Dramatically

The financial implications of living longer than expected are profound:

- Extended Income Needs: Retiring at 65 and living to 95 requires funding 30 years of retirement, compared to just 20 years if living only to 85. This isn’t just 50% more time; compounding inflation makes it significantly more expensive.

- Increased Healthcare Costs: The later years often bring substantially higher medical and long-term care expenses, which inflation impacts heavily.

- Social Security & Pension Strain: Outliving the “break-even” point for delayed Social Security becomes a major advantage, while fixed pensions without robust COLAs lose significant purchasing power over extra decades.

- Reality Check: According to Social Security Administration data, a healthy 65-year-old today has approximately a 25% chance of living to age 90 or beyond. Planning only to age 80 or 85 ignores a substantial probability of needing funds for much longer.

Ignoring longevity risk can lead to prematurely depleted savings, forcing drastic lifestyle reductions or dependence on family later in life. Integrating realistic longevity projections – planning conservatively to age 95 or even 100 – into your savings targets and withdrawal strategy is paramount. Tools like the retirement calculator at https://imakedollar.com allow you to stress-test your plan against extended lifespans and varying market conditions, providing clarity on adjustments needed today.

【The Ideal Order: Where Most Plans Go Wrong】

Building upon the critical need to manage assets flexibly and plan for longevity, the sequence of your planning steps is equally pivotal. Many well-intentioned savers inadvertently sabotage their retirement security by tackling the process backwards, focusing on mechanics before meaning and investments before income stability.

Skipping the “Dream First” Approach

The most common misstep is diving straight into spreadsheets and savings targets (“How much do I need?”) before defining the actual lifestyle those dollars must fund (“What do I want my retirement to look like?”). This often leads to significant underestimation of real-world costs.

Focusing solely on savings targets before defining lifestyle costs

Projecting a comfortable $5,000 monthly budget sounds achievable until specific dreams are quantified. Consider the case of a retiree who meticulously budgeted for $5,000/month covering basic living expenses. However, their unspoken aspiration was extensive international travel. Factoring in just two significant trips per year quickly revealed a true monthly need of $7,500. Discovering this gap after retiring forces painful compromises or unsustainable withdrawal rates. Defining desired experiences first – travel, hobbies, relocation, family support – provides the essential cost basis for an accurate savings target.

Ignoring non-financial retirement preparation

Financial readiness is only half the equation. Industry studies consistently reveal that a staggering 68% of unhappy retirees cite a “purpose deficiency” as their core struggle. Leaving a demanding career without a plan for meaningful engagement, social connection, or intellectual stimulation often leads to rapid dissatisfaction and depression, regardless of financial security. Proactively exploring passions, volunteer opportunities, part-time work, or educational pursuits before the retirement date is crucial for long-term well-being. A fulfilling retirement requires designing your days, not just your dollars.

Backward Priority Sequencing

Even after defining lifestyle costs, the order of implementing financial strategies is frequently reversed, amplifying risk unnecessarily.

Starting investment strategies before income planning

Jumping directly into portfolio allocation without first securing reliable, predictable income streams is like building a house without a foundation. Sequence-of-returns risk – poor market performance in the early retirement years – causes an estimated 23% portfolio failure rate within the first 5 years under rigid withdrawal plans. Prioritizing income planning means:

1. Optimizing Guaranteed Income: Maximizing Social Security claiming strategy (often delaying for higher lifetime benefits), understanding pension options, and exploring SPIAs (Single Premium Immediate Annuities) for a portion of assets to cover essential expenses.

2. Building a Cash Buffer: Establishing 1-3 years of living expenses in cash/cash equivalents before full retirement. This acts as a shock absorber, allowing you to avoid selling investments during market downturns.

Only after these income and stability layers are in place should the focus shift to long-term growth investing for the remaining portfolio.

Prioritizing tax-deferred accounts over liquidity buckets

The allure of upfront tax deductions often leads to overfunding 401(k)s and IRAs at the expense of accessible taxable or Roth accounts. This creates a dangerous liquidity crunch, especially in early retirement before age 59.5. Data shows emergency fund gaps force 41% of early retirees into penalty withdrawals (10% penalty + income tax) from tax-deferred accounts when unexpected expenses arise. A balanced approach prioritizes:

* Emergency Fund: 3-6 months of expenses (liquid, accessible).

* Pre-59.5 Spending Bucket: Taxable brokerage accounts and Roth IRA contributions (which can be withdrawn penalty-free at any time) to fund living expenses before accessing tax-deferred funds.

* Tax-Deferred & Roth Growth: Funds earmarked for later retirement phases or legacy goals.

Neglecting accessible capital forces costly, irreversible decisions. Tools like the comprehensive planners at https://imakedollar.com can help model the optimal sequencing of withdrawals across different account types to minimize taxes and penalties while ensuring necessary liquidity throughout your retirement journey.

【Tax Traps That Shrink Your Nest Egg】

Transitioning from the critical errors in planning sequence and income stability, we arrive at another pervasive threat to retirement security: unseen tax liabilities. Even diligent savers can see hard-earned wealth eroded by complex tax rules governing registered accounts. Missteps here are often irreversible and devastatingly costly.

The RRSP Meltdown Disaster

The forced conversion of RRSPs to RRIFs at age 71 is a pivotal moment demanding precise strategy. Errors in timing or income projections can trigger punitive tax consequences and benefit clawbacks.

Timing errors in registered account withdrawals

Converting an RRSP to a RRIF too early, or delaying withdrawals until forced minimums kick in, can create massive, unnecessary tax bills. Consider a retiree with a sizable RRSP who converts to a RRIF at 65, triggering mandatory minimum withdrawals they don’t yet need. This inflates their taxable income prematurely, pushing them into higher brackets for years. The real disaster strikes if this inflated income persists into age 71, forcing even higher mandatory RRIF withdrawals layered on top of other income (like CPP or part-time work). The compounding effect? A potential $350,000+ destruction of tax-free wealth over a 25-year retirement compared to a strategically phased withdrawal plan. This wealth isn’t lost to markets; it’s surrendered to the Canada Revenue Agency.

Overlooking clawback thresholds

Guaranteed government benefits like Old Age Security (OAS) are vital income supplements, but they come with stealth taxes for higher-income retirees. In 2025, the OAS recovery tax (clawback) begins when net world income exceeds $86,912. Every dollar of income above this threshold results in a 15% clawback until OAS is fully recovered. Failing to model RRSP/RRIF withdrawals, pension income, investment returns, and even part-time earnings against this threshold is a critical oversight. A retiree nudging just $1,000 over the limit loses $150 of OAS immediately. Consistently exceeding it by $10,000 means forfeiting $1,500 annually – a significant erosion of guaranteed, inflation-protected income.

TFSA Missteps You Can’t Afford

While the Tax-Free Savings Account (TFSA) is a powerful tool, mismanagement turns its benefits into penalties or squanders its immense long-term potential.

Contribution room miscalculations

The CRA tracks TFSA contribution room, but the onus is entirely on the individual to track deposits and withdrawals accurately. Over-contributing, even unintentionally (e.g., forgetting a large withdrawal made late in the previous year, or miscalculating cumulative room), triggers a harsh penalty. The penalty is 1% per month on the highest excess amount in that month. Based on 2023 CRA enforcement data, common over-contribution errors often resulted in penalties averaging $6,500 per occurrence. This is pure penalty, not tax – a direct drain on retirement capital for an easily avoidable mistake.

Using TFSAs as short-term savings vehicles

The TFSA’s name (“Savings Account”) misleads many into treating it like a regular bank account for emergency funds or short-term goals. While accessible, this severely underutilizes its primary superpower: permanent, tax-free compound growth. Consider two savers contributing the maximum annually for 20 years. Saver A uses their TFSA purely for long-term growth (e.g., diversified ETFs). Saver B frequently withdraws for vacations or cars, keeping the bulk in cash. Assuming a conservative 6% average annual return, Saver A’s maxed, untouched TFSA could grow to approximately $250,000, entirely tax-free. Saver B, utilizing only half the potential growth period effectively due to withdrawals and cash drag, might accumulate only $125,000. That’s a $125,000 difference in estate value or accessible retirement capital – purely from strategy, not contribution amount. The TFSA’s greatest value lies in decades of uninterrupted compounding, shielded forever from taxes.

Navigating these intricate tax rules, thresholds, and account-specific pitfalls requires meticulous planning and ongoing monitoring. Strategic withdrawal sequencing across RRSPs/RRIFs, non-registered accounts, and TFSAs is paramount to preserving wealth. Platforms like https://imakedollar.com offer sophisticated tools to model these scenarios, helping you avoid costly traps and optimize every dollar throughout your retirement journey.

【Withdrawal Strategies: The Silent Wealth Killer】

Moving beyond the tax traps that can erode your registered accounts, we confront a subtler but equally destructive force: flawed withdrawal strategies. Even with a solid nest egg, how you access your funds dictates whether your retirement thrives or falters. Errors here operate silently, compounding over decades to slash wealth through poor market timing, inefficient sequencing, and overlooked pension synergies. Let’s dissect the critical myths and blunders that turn careful savings into avoidable losses.

The 4% Rule Myth

The infamous “4% rule” – withdrawing 4% of your portfolio annually, adjusted for inflation – was once a retirement staple. But in today’s volatile markets and extended lifespans, this static approach is dangerously outdated. Blind adherence ignores sequence-of-returns risk and inflation spikes, setting retirees up for premature depletion.

Why static percentages fail modern retirees

Static withdrawals don’t adapt to real-world market swings or longevity. A 2025 study analyzing 30-year retirement simulations revealed a 6.3% failure rate for portfolios starting with a 4% withdrawal rate – meaning over 6% of retirees outlive their money despite “safe” assumptions. This happens because early market downturns amplify losses when withdrawals are fixed, locking in losses and starving recovery. For example, a retiree withdrawing $40,000 annually from a $1 million portfolio in a bear market could see their balance halved within a decade, forcing drastic cuts later or risking insolvency. Inflation compounds the problem: a 3% annual rise means that “safe” $40,000 withdrawal effectively becomes $72,000 in 20 years, straining portfolios not designed for dynamic pressures.

Dynamic withdrawal alternatives that actually work

Flexible, rules-based strategies outperform rigid percentages by responding to market conditions. The guardrail method is a standout: it sets upper and lower withdrawal bounds (e.g., ±10% of the initial rate) and adjusts annually based on portfolio performance. If markets surge, withdrawals increase modestly; if they slump, withdrawals drop to preserve capital. This approach slashed the failure probability to just 1.8% in the same 2025 study. For instance, a retiree starting with a 4% withdrawal ($40,000) might scale back to $36,000 after a 20% market drop, protecting their nest egg. After a recovery, they could rebound to $44,000 – balancing sustainability with lifestyle needs. Other tactics include the “floor-and-ceiling” strategy, which ties withdrawals to inflation and portfolio thresholds, ensuring resilience without guesswork.

Account Sequencing Blunders

Withdrawal order across account types – RRSPs/RRIFs, TFSAs, and non-registered funds – is a tax minefield. Get it wrong, and you trigger cascading liabilities that drain wealth. Ignoring how government pensions interact with these withdrawals magnifies the damage, turning modest income into a tax bill bonanza.

Tax-inefficient withdrawal orders

Pulling funds from the wrong accounts first can inflate lifetime taxes by 15% or more. For example, tapping RRSPs/RRIFs early (before age 65) often pushes retirees into higher brackets prematurely, while delaying TFSA withdrawals wastes tax-free growth. A better sequence: start with non-registered accounts to benefit from capital gains treatment (only 50% taxed), then use TFSAs for mid-retirement needs (tax-free), and finally draw RRSPs/RRIFs later when other income drops. Misfiring this order – say, prioritizing RRIF withdrawals while still working part-time – layers taxable income, potentially adding $150,000 in extra taxes over 25 years. This isn’t market loss; it’s self-inflicted erosion from poor sequencing.

Pension integration oversights

Government pensions like CPP and OAS are designed to fill lower tax brackets first, but retirees often withdraw registered funds concurrently, wasting this advantage. Failing to integrate pensions triggers marginal rates of 29%+ on income that could have been taxed at 15%. For instance, in 2025, the first $50,000 of income might be taxed at 15%, but adding RRIF withdrawals atop a $20,000 CPP/OAS base pushes excess into the 29% bracket. A retiree withdrawing $30,000 from a RRIF unnecessarily while receiving pensions pays ~$8,700 in tax vs. $4,500 if they’d paused RRIFs to let pensions occupy the lower bracket. Over 20 years, this oversight could cost $85,000+ – easily avoided by timing withdrawals to “fill” brackets efficiently.

Optimizing your withdrawal strategy demands foresight and adaptability, turning silent wealth killers into growth opportunities. For personalized modeling to navigate these complexities, leverage tools at https://imakedollar.com, ensuring every dollar works harder throughout your retirement journey.

【The Retirement Checklist Most Skip】

While withdrawal strategy errors silently drain portfolios, three equally dangerous blind spots lurk in the shadows of retirement planning. These aren’t market risks or tax codes—they’re cognitive gaps where assumptions trump evidence, and complacency overrides calculation. Overlooking them guarantees preventable financial erosion.

Inflation Blind Spots

Retirees fixate on headline inflation (2.1% CPI) while medical costs silently accelerate at 6.9% annually—over 3x faster. This divergence creates a “healthcare inflation tax” that compounds brutally over decades.

Underestimating healthcare cost inflation

A 65-year-old couple retiring in 2025 faces $12,000/year in premiums, deductibles, and uncovered care. By age 85, that balloons to $48,000/year (adjusted for 6.9% medical inflation). Yet most budget using general CPI, underfunding healthcare by 34% on average. The math is unforgiving:

| Age Range | Annual Healthcare Cost (2025$) | CPI-Adjusted Equivalent | Shortfall |

|---|---|---|---|

| 65-74 | $12,000 | $12,000 | $0 |

| 75-84 | $22,000 | $16,100 | $5,900 |

| 85+ | $48,000 | $21,800 | $26,200 |

| This gap forces retirees to slash discretionary spending or raid principal later in life when recovery is impossible. |

Longevity miscalculations

65-year-olds now have a 25% probability of reaching age 95 (Society of Actuaries, 2025)—yet most plan only to 85. Underestimating longevity by 10+ years causes catastrophic miscalculations:

- A $500,000 portfolio lasting 20 years at 4% withdrawals collapses in year 23 if lifespans extend

- Delaying CPP to 70 boosts lifetime benefits by 42%, but 67% of applicants still claim at 65, forfeiting $100+/month

Pension Plan Pitfalls

Government pensions appear simple until integration errors trigger six-figure losses.

Government benefit miscalculations

Claiming CPP at 60 vs. 70 permanently reduces monthly income by 36%—a $100+/month mistake for average earners. Worse, 41% of retirees trigger OAS clawbacks by failing to coordinate RRIF withdrawals. In 2025, every $1 of income over $90,000 reduces OAS by $0.15. A $95,000 RRIF withdrawal could thus cost $750 in lost OAS—on top of income tax.

Survivor benefit oversights

60% of widows experience a 30%+ income drop due to poor pension elections. Common failures:

- Not electing joint-and-100% survivor pensions (default is often 60%, slashing widow’s income)

- Overlooking CPP survivor benefits (up to 60% of deceased’s pension)

- Forgetting GIS top-ups vanish upon spouse’s death, compounding losses

The Financial Literacy Gap

Complexity breeds overconfidence—the SEC’s 2025 review shows self-planned portfolios underperform professionally validated ones by 3.2% annually due to behavioral errors and knowledge gaps.

DIY planning without professional validation

Self-planners typically:

- Overweight familiar stocks (35% average home-country bias)

- Misjudge risk tolerance (panic-selling dips 40% more often)

- Overlook tax-efficient asset location (costing 0.8%/year in drag)

Estate plan disconnects

Beneficiary conflicts and probate issues drain 15% of estate value on average. Top oversights:

- Naming ex-spouses on RRIFs/TFSAs (overriding current wills)

- Forcing equal inheritances that illiquid heirs must sell

- Ignoring probate fees on non-beneficiary accounts ($14,500 per $500k in Ontario)

These invisible cracks in retirement foundations demand proactive audits—not reactive fixes. For a personalized assessment of your blind spots, explore evidence-based modeling at https://imakedollar.com, where dynamic planning adapts to both markets and life’s unpredictability.

Key Takeaways for a Secure Retirement

Retirement success hinges on three pillars: accurately projecting lifestyle costs, strategically withdrawing funds to minimize taxes, and adapting to inflation—especially in healthcare. Remember:

- Travel and hobbies require dedicated budgeting (often $8,000+/year)

- Healthcare costs triple after age 70 due to Medicare surcharges

- Roth conversions before age 72 can save $100k+ in lifetime taxes

Take action now: Use our calculator at https://imakedollar.com to model your 2025 withdrawal strategy. Share your retirement vision in the comments below!